A proxy against Inflation

On how alternative asset classes can provide a hedge for the increasing inflation expectations and a review of my favorite private equity firms that can be used as a proxy. BAM and BX.

Hi Everyone 👋

Welcome to the new subscribers who have joined Aconomics. If you’re reading this but haven’t subscribed, join our community! 👇

This article has to be put in context so lets do that before we proceed, shall we?

Advanced economies have entered a medium inflation range of about 2.5 to 4.5%. This rate is higher than what we’re used to and can impact the real returns of our portfolios and portfolio companies.

As the crypto crowd keeps pointing out, it’s very likely that we’re going to live with higher than usual inflation for a while considering the amount of money that’s been pumped into the economy.

If you want to skip the inflation / alternative assets mini lecture and want to go directly to the stock picks, I understand, just scroll down like nobody’s watching 👀

So my objective is to analyze some private equity firms that in normal times are a good addition to any diversified portfolio but they become a very good addition when inflation grows 🔝

By the way, very important! While causation and correlation can exist at the same time, correlation doesn't mean causation. That’s it, lets continue ✅

Assets correlation to inflation

Asset correlation is an important measurement to analyze how investments move relative to one another. It’s typical for market movements to cause various assets to move in the same general direction.

We can see the highest correlation between comparable assets like in crypto for example where the movement of Bitcoin will create a wave of bigger same-direction movements on most alt coins.

So, we know that in general, equities perform poorly when inflation goes up. Rising inflation has insidious effects for obvious reasons: input prices are higher, consumers can purchase less goods and revenues / profits decline ⚠️

But lets look at what assets work best when inflation goes up…

This has been studied ad nauseam by economists and statisticians everywhere (see references at the bottom for a list of research papers) and most lists include alternative assets:

An alternative investment is a financial asset that does not fall into one of the conventional investment categories like stocks, bonds, and cash.

Real estate or REITs (Real estate investment trusts) 🏘️

Real estate is less susceptible to short term macroeconomic news because their prices are usually tied to long-term leases that can be adjusted with inflation every year, making them a very attractive hedge against inflation. And the correlation between the S&P 500 and American REITs is about 0.6, a moderate positive relationship.

Commodities 💡

Commodities are a broad category that includes grain, precious metals, electricity, crude oil, coffee, natural gas, cotton, sugar, and natural gas, as well as foreign currencies, emissions, etc. Commodities and inflation have a unique relationship because commodities are an indicator of inflation to come. They tend to bear a low to negative correlation to traditional asset classes.

Gold and other precious metals 👑

Also part of commodities but gold is often thought of as a safe haven investment during times of market volatility and uncertainty.

There are many other assets that can be included in a portfolio that act as a hedge against inflation and have low correlation with the stock market but bear in mind that many of them carry a higher risk for a myriad of reasons including low liquidity in that specific market or less public information.

Alternative asset classes in private equity

Lets get down to the nitty-gritty of this dilemma and the companies that might help us navigate through it unscathed.

If you participate in the markets and like most of us, cant include a broad enough range of assets to your portfolio that will allow you to sleep through high inflation and market volatility knowing that your capital is secure, this private equity companies with a large exposure to alternative investments might be a solution.

There are a few PE firms that invest in alternative assets but I’ll cover my 2 favorites: Brookfield Asset Management (BAM) and Blackstone Group (BX).

Before we start, take a look at this predictions by Preqin on the growth that is expected from the industry:

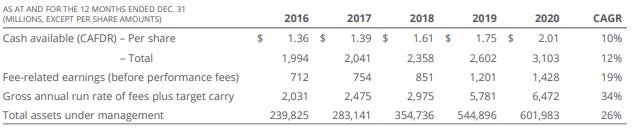

Brookfield Asset Management (BAM)

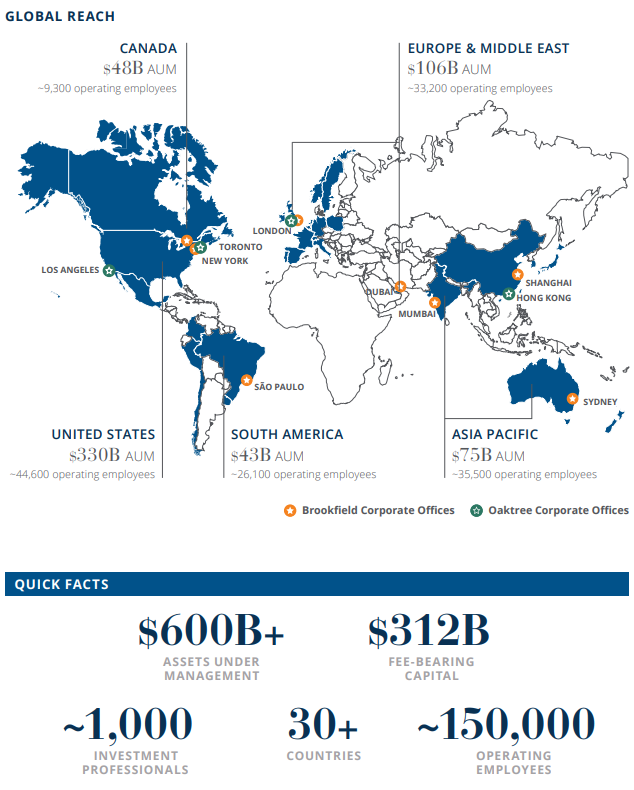

A leading global alternative asset manager from Canada and one of the largest investors in real assets in the world. Their investment focus is on real estate, renewable power, infrastructure and private equity assets.

Led by Bruce Flatt who is regarded as one of the best capital allocators alive today, with an annualized return of 19% per year since 2002!

With over 600B under management, they own:

210B in Real Estate with over 500M square feet that contain offices, retail, multifamily, hospitality, student housing and triple net lease assets. Among the properties we can find Canary Wharf in London, Potsdamer Platz in Berlin and Powai in Mumbai.

95B in Infrastructure making them the largest infrastructure investors in the world with Utilities (like 6.6 million electric and gas connections, 2700 km regulated natural gas pipelines), Transport (including 13 ports, toll roads and over 30000 km in rail operations), Energy (like the 16500Km of natural gas pipelines) and Data Infrastructure (including 52 Data centers and 20000 Km of fiber backbone)

59B in Renewable Power with 8000 MW of Hydro capacity (I dont know what that even looks like either but it includes 222 generation facilities and 83 river systems. Google “Isagen Colombia” or “holtwood hydro”), 5800 MW of installed Wind capacity (Bord gais), 2200 MW of Solar installed capacity in 4 continents and more.

73B in Private Equity that they use to acquire high-quality businesses with barriers to entry. This include over 1000 completed construction projects, biodiesel construction facilities, manufacturers of automotive batteries, returnable plastic packaging, clean water plants (with 15 million customers in Brazil) and residential developments that ranks up to over 83000 single family lots.

153B managed by Oaktree Capital Management run by the Howard Marks, another legend in finance. In 2019, Brookfield acquired a majority interest in Oaktree, and it continues to operate as a standalone business.

With an average price target 55.69, a portfolio of assets that scream INFLATION HEDGE, a growing gross margin of 26% and a small dividend (1.04%), this stock is one of my favorites.

One thing to be aware if you decide to go deeper into BAM is that Brookfield has public subsidiaries. Perfect for investors that want to invest in just one area of their business:

Blackstone Group (BX)

A huge American alternative investment management company from New York, created by Peter Peterson and Stephen Schwarzman after leaving Lehman Brothers. They invest across the alternative asset classes in private equity, real estate, credit and hedge funds as well as in infrastructure, life sciences, insurance, and growth equity.

They manage over 600B and for their size, they have an incredible low debt of only 6.6B. Schwartzman an his team have been so prolific and have built such an acquisitions machine that if you’re wandering if they own anything in your country or town just Google “Blackstone + your city/country” - They do right?

On Private Equity they manage 112B with a portfolio of 95 companies and have 39B available to invest. They own a majority stake in companies like Ancestry.com, Refinitiv, Bumble and Aypa power.

Real Estate with 196B of Investor capital under management but a portfolio value of whooping 378B. Their properties range from apartment buildings in NY and resorts in Las Vegas to huge acquisitions in Germany, France, UK, Spain, Singapore and - everywhere, just everywhere.

51B in Infrastructure and another 15B in committed capital. And as Brookfield, they operate in energy, water and waste, transportation and communications.

They are investing in Life Sciences with partnerships with Pfizer, Anthos Therapeutics, among other pharmaceutical, medical and biotech companies to fund their late stage research and bring drugs to market.

Tactical Opportunities is the name they gave to a vehicle that has 32B in AUM with 143 investments so far that ranges from Wireless Cellular infrastructure to mining companies.

Hedge Funds, they created a portfolio of hedge funds and with 82B AUM to create customized portfolios of alternative investment strategies and they’ve done it successfully for over two decades.

Blackstone, much like Brookfield but bigger, is one of those companies that is so massive and so diversified that its very hard to go through everything. But the most important aspect of Blackstone for me is the weight of Real Estate, Private Equity and Infrastructure on their balance.

With an average price target below the current price, but the high target sitting at 100 usd for now, its still a long term buy from my point of view. The growth rate of Blackstone is high and they are taking every advantage that the corona crisis generated to buy good assets at discounted prices.

As we can see, their portfolio is perfect for high inflation periods, very low debt, a growing gross margin of over 70% and a 2.84% dividend, this stock is obviously also one of my favorites.

Brookfield Asset Management & Blackstone Group are just going to keep growing and to me, they’re a clear long term buy-and-hold. Bruce Flatt and Stephen Schwarzman are incredible at what they do and have a long term vision for their respective companies, they are patient with capital but will act to buy amazing assets when the opportunity rises. Oh, and they have a boat load of available capital 💰

Until next time!

And again, thank you for subscribing! If you like my content, I would highly appreciate you sharing it. And if you see a typo, an error or have anything else to point out, I don’t give a f! Just kidding, please let me know in the comments or connect with me on twitter @aconomicscom :)

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. In any case, transparency is paramount so my portfolio can be viewed here.

References:

Inflation hedging portfolios in different regimes BY Marie Brière and Ombretta Signori.

Real Assets and Inflation: Which Real Assets Hedge Inflation BY Rajan Parajuli and Sun Joseph Chang.

Portfolio Diversification Managing Correlation Risk with Alternative Investment BY Liman None Suleman.