Archegos biblical losses

In Hwang they trusted. Again. Billions lost, people fired and we're still waiting on that legislation. The story has all the ingredients to be a Netflix or a ViacomCBS docuseries.

Hi Everyone 👋

Welcome to the new subscribers who have joined this last week. If you’re reading this but haven’t subscribed, join our community, it's focused on economics, finance, stock market and crypto 👇

Three weeks ago the managing director of a family investment vehicle called Bill Hwang got calls from a bunch of banks requesting more capital for margin, his leverage was 5 to 1 and with some of the securities going down +20% he was already in the red. The fire sale that followed sent shockwaves throughout Wall Street.

The story of Archegos Capital fascinates me because it involves:

Bill Hwang who believes that God wanted him to invest in companies because “When we create good companies through the capitalism that God has allowed, it enhances people’s lives … God delights in those things” here’s the video

Greedy investment banks

Derivatives (again!)

Failure in legislation

So lets do this

Who is Bill Hwang?

Not much is known and most of his public appearances where focused on his theology and Christianity. The son of a Korean pastor, Bill Hwang moved to the US as a child and earned an economics degree from UCLA and an MBA from Carnegie Mellon.

After meeting the now billionaire and renowned hedge fund manager Julian Robertson while working as an investment banker, Hwan went to work for him at Tiger Management up until its closing when he received 25 million from Robertson to start “Tiger Asia Management”

Robertson is credited with turning $8 million in start-up capital in 1980 into over $22 billion in the late 1990s, though that was followed by a rapid downward spiral of investor withdrawals that ended with the fund closing in 2000. After the fall, he gave seed capital to former employees that now manage 50 of the worlds top hedge funds, these employees are still referred to as “Tiger Cubs” and Bill Hwang is one of them

His new fund was created in 2001 and reached over 8 billion in assets under management in 2007 with a 40% annualized return apparently. The amazing fund and it’s story came to an end in 2012, when Hwang was accused of Insider Trading by the SEC and had to pay a settlement of 44 million dollars. Two years later he was banned from trading in Hong Kong for 4 years and was also blacklisted by banks like Goldman Sachs.

Insider trading is the buying or selling of a publicly traded company's stock by someone who has non-public, material information about that stock which is any information that could substantially impact an investor's decision to trade the security that has not been made available to the public.

Just 12 months after he was forced to return money to his investors, Hwang was back at work and created Archegos Capital Management which started operating in 2013 as a family office for the Hwang family fortune.

Greedy investment banks

More Money? No Problem. By 2021 every bank was working with him, with highly leveraged positions. Hwang was aggressive on his investments and signed very lucrative derivatives with each bank for billions of dollars.

With a 5 to 1 leverage you better have certainty or more cash on your side. Many of Hwang positions were in Chinese stocks that had been declining due to Chinese government smack down of its tech moguls and the strong dollar didn’t help.

Viacom-CBS was also a huge position for Archegos, and while the Chinese stocks where going down and banks were calling for more margin, ViacomCBS decided to launch a 3 billion offering to fund streaming business which caused the stock to go down massively:

As we can see, this caused dumping in Viacom-CBS, which led to more margin calls on Archegos. The banks like Goldman Sachs, Morgan Stanley and Credit Suisse began closing out leveraged positions at fire sales prices.

Other banks that stalled lost billions of dollars, and Archegos lost even more as its cash and positions disappeared, and banks made demands for balances due.

Nomura Holdings apparently lost 2 billion dollars, Credit Suisse might be above 4 billion and Mitsubishi UFJ reported a loss of around 300 million. JPMorgan analysts calculate that Wall Street total losses could reach 10 billion dollars

But how come nobody realized they had such a big exposure? Well, the securities where never under Archegos name by using Derivatives.

Derivatives “Ups, I did it again.”

Archegos Capital used a Total Return Swaps to retain anonymity.

These total return swaps are derivative contracts that allow an entity like Archegos to take on exposure of the profits and losses of a portfolio of stocks or other assets without directly owning them in exchange for a fee.

This contracts are very popular with hedge funds because they provide the upside of a large exposure to an asset with low cash outlay.

The problem with these derivatives is the lack of transparency and as we should have learned by now is that wall street without transparency has a tendency of spiraling out of control.

The commission traders pushed risk management to whitelist a known irresponsible investor because he was moving big amounts. It was reported that Goldman Sachs was the last one to whitelist him in 2020.

If the exposure of Archegos would have been apparent (i.e. not using TRS) then everybody in the industry, including ViacomCBS would have known who had what and the banks would’ve been more aware of the perils of dealing with Hwang.

Legislation is coming! But don’t wait up

After the financial crises of 2008, the politicians and legislators looked serious in their intent to regulate the derivatives market and bring more transparency into the markets.

Archegos Capital blowout is throwing a spotlight on the fact that nothing has been done. The Dodd-Frank Act of 2010 had the objective of solving this issue but we’re 11 years in and still nothing.

Apparently, the SEC rules are due for November and will allow them to have access to data on every position and trade done by or for an entity using swaps. And would increase the margin requirements to an international standard (Basel and Iosco)

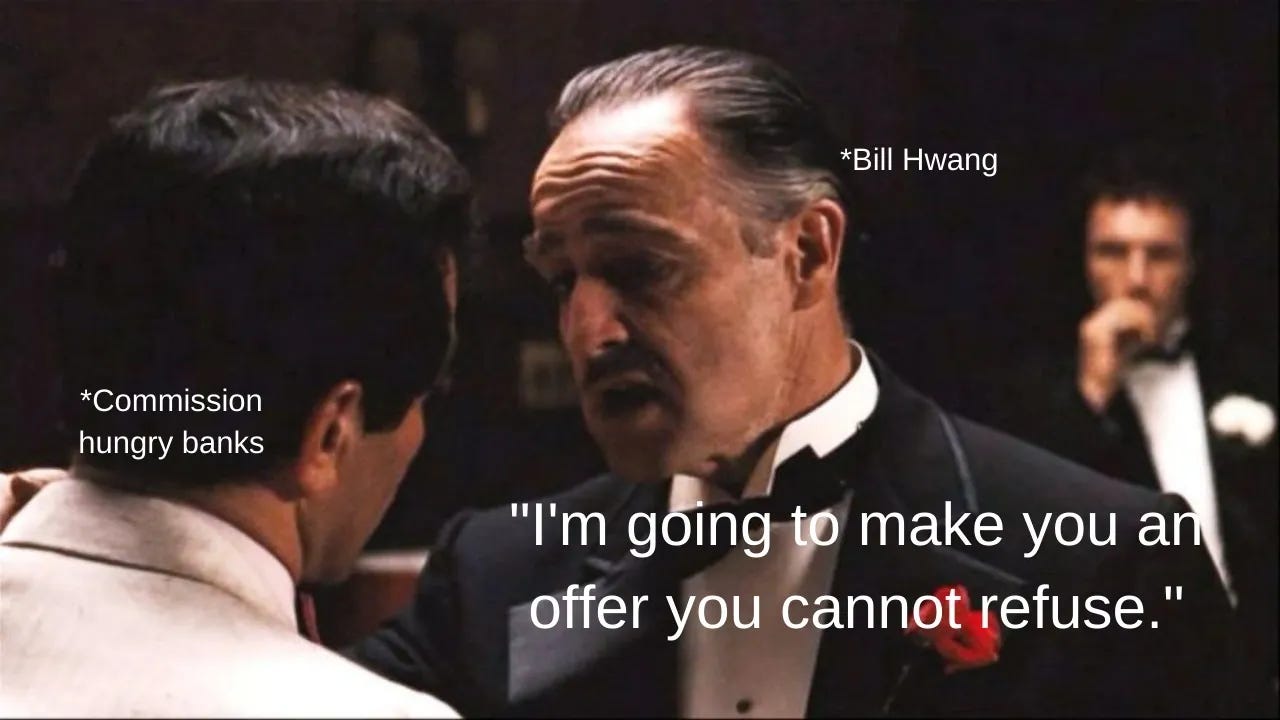

In the end, this meme summarizes it:

Again, thank you for subscribing! If you like my content, I would highly appreciate you sharing it. And if you see a typo, an error or have anything else to point out, I don’t give a f! Just kidding, please let me know in the comments or connect with me on twitter @aconomicscom :)

Like always, thank you. Remember to hedge your bets, ponder claims and think long term 👍

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. In any case, transparency is paramount so my portfolio can be viewed here.

Thank you for another great clear and transparent inside. I like the article very much. I can't wait for the next one.

brilliant. keep em coming!