Lam Research ($LRCX) Stock Analysis - Chip Equipment Maker to Play the Semiconductor Industry

With a Market Cap of 77.72B, an EV of 78.11B, a PE ratio of 18.7, a dividend of $1,50/Q and an active $5B share repurchase program. It looks like a good long term play on the semiconductor industry 🚀

Hello! 👋

Welcome to the new subscribers who joined this week! If you’re reading this but haven’t subscribed, do it, join the community! 👇

Semiconductors, semiconductors, semiconductors….. the media has been obsessing about them and the shortage that we’ve seen since late 2020. It’s like we all just realized that our semiconductor needs are growing faster than expected!

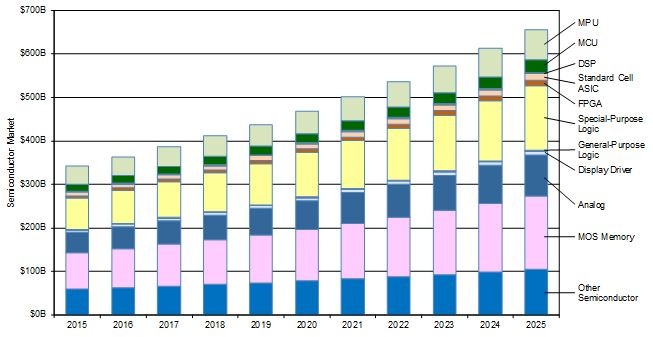

But with the growth of crypto, IoT, Electric cars/motorcycles (I’ve covered NIO and NIU), advanced medical care, mobile, tv, and 1000 more, we KNOW that the industry is just going to keep increasing revenue and it might be the best time to invest if you haven’t already.

This week, in 10 minutes or less, we’ll cover:

Semiconductors

Lam Research history

Financial Results

Stock & Price Target

More semiconductor stocks that I like

Semiconductors

Semiconductors enable the systems and products that we use to work, communicate, travel, entertain, harness energy, treat illness, make new scientific discoveries, and more. I’m not an expert on semiconductors nor I understand the intricacies of every advancement or technology so I’m going to make this about the industry as a whole as we’ll be focusing on a big player later on.

A few points before we jump into Lam Research:

Semiconductors are a very complicated and expensive product. Opening up a new manufacturing plant requires billions of dollars.

Because of their complexity, not one company can develop and manufacture everything. There are companies focused on equipment, on foundry, “fabless” chip makers, memory/logic, etc. And the companies are spread around the world making the probability of bottlenecks higher (Eg. Supply chain problems)

And last but not least, after 2020 we’ve seen a rise in nationalism and a push to increase their local production capacity from many governments, that’s why we see a spike in projected Capex from all the big companies (Intel, ASML, etc.) - The U.S. Senate recently passed a $52 billion bill to support domestic semiconductor manufacturing and R&D to usher more chip production onto American soil.

Lam Research history

Basically, Lam Research Corporation (incorporated in 1980 and is headquartered in California), designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits. It sells its products and services in the United States, China, Europe, Japan, Korea, Southeast Asia, Taiwan, and internationally.

Founded in 1980 by a the Chinese-born American technology entrepreneur David K. Lam, he earned a Doctoral and Master degrees in chemical engineering from M.I.T as well as a Bachelor degree in engineering physics from the University of Toronto. And he was also the first Asian-American CEO to take a company public on the NASDAQ.

Since December 2018, Tim Archer has been the President and CEO of the company, the same year as the world reached 1 trillion semiconductors shipped worldwide. And the company has not stopped. With a world wide presence, they continue to open Engineering and R&D Facilities and Developing technology by themselves and in conjunction with other companies in the industry like ASML and IMEC.

Financial Results

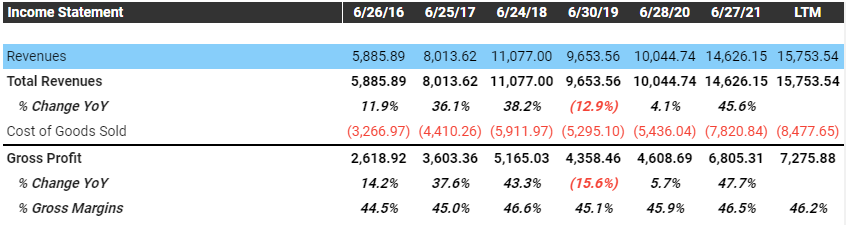

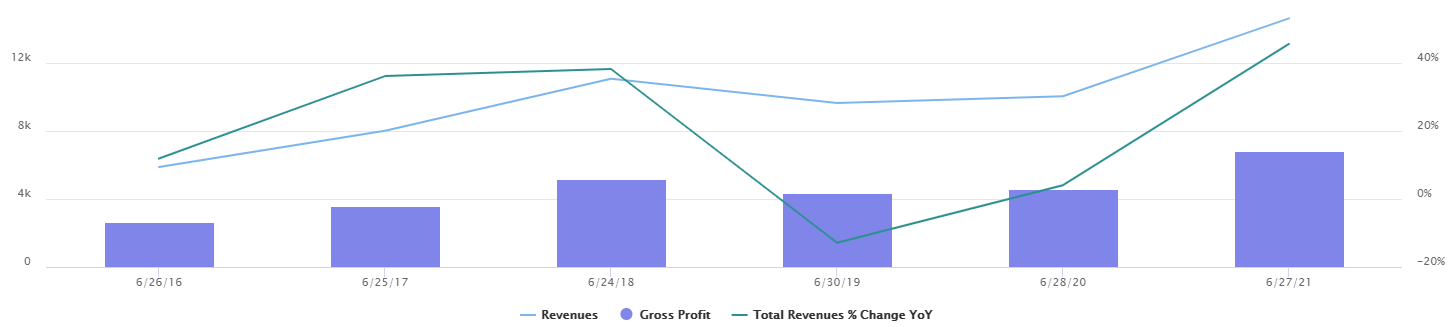

Lam Research published their quarter earnings recently and it’s their 6th consecutive quarter of revenue growth and EPS growth. They point out that Broad-based demand strength expected to drive another year of spending growth in 2022.

The growth of Lam is in direct correlation with the Capex ups and downs of its clients like Micron, Samsung, SK Hynix and TSMC among others. As the need for new equipment to satisfy growing demand rises, so does Lams revenue.

Looking at Lams financials, there are many things that look very good but here are my top four:

Gross Margin (LTM 46.2%) and Operating Margin (LTM 31.1%) continue to grow steadily.

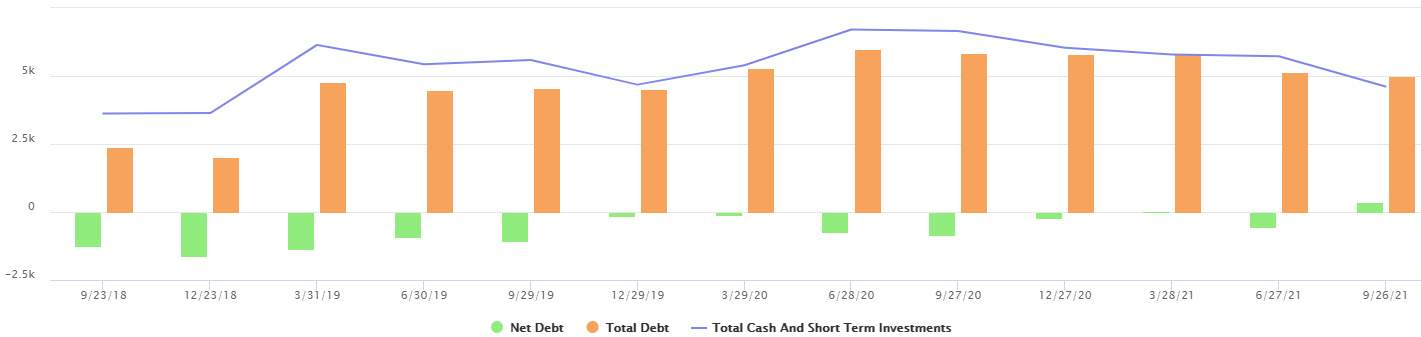

Total Cash and Short Term Investments are 4.611B usd LTM and Total debt is 4.995B → Net Debt is 383.71M usd. super low.

Revenue has grown from 5.88B in 2016 to 15.753 LTM (2021).

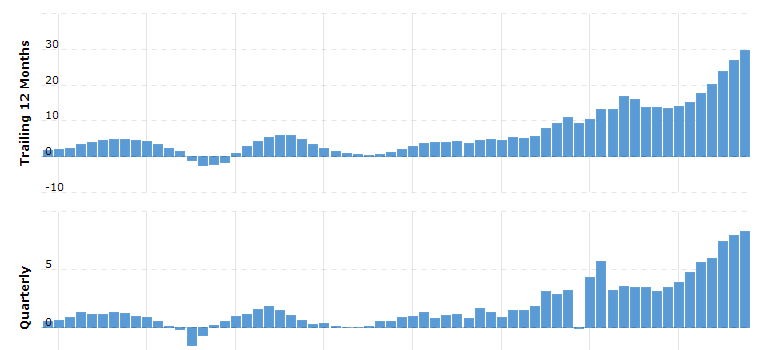

EPS or Earnings per Share have been growing steadily and in 2021 is almost 30 usd (graph by quarter):

So as you can see, the financials look promising. They provide an image of a growing company and if the industry continues to grow, this is a good company to hold for a long time.

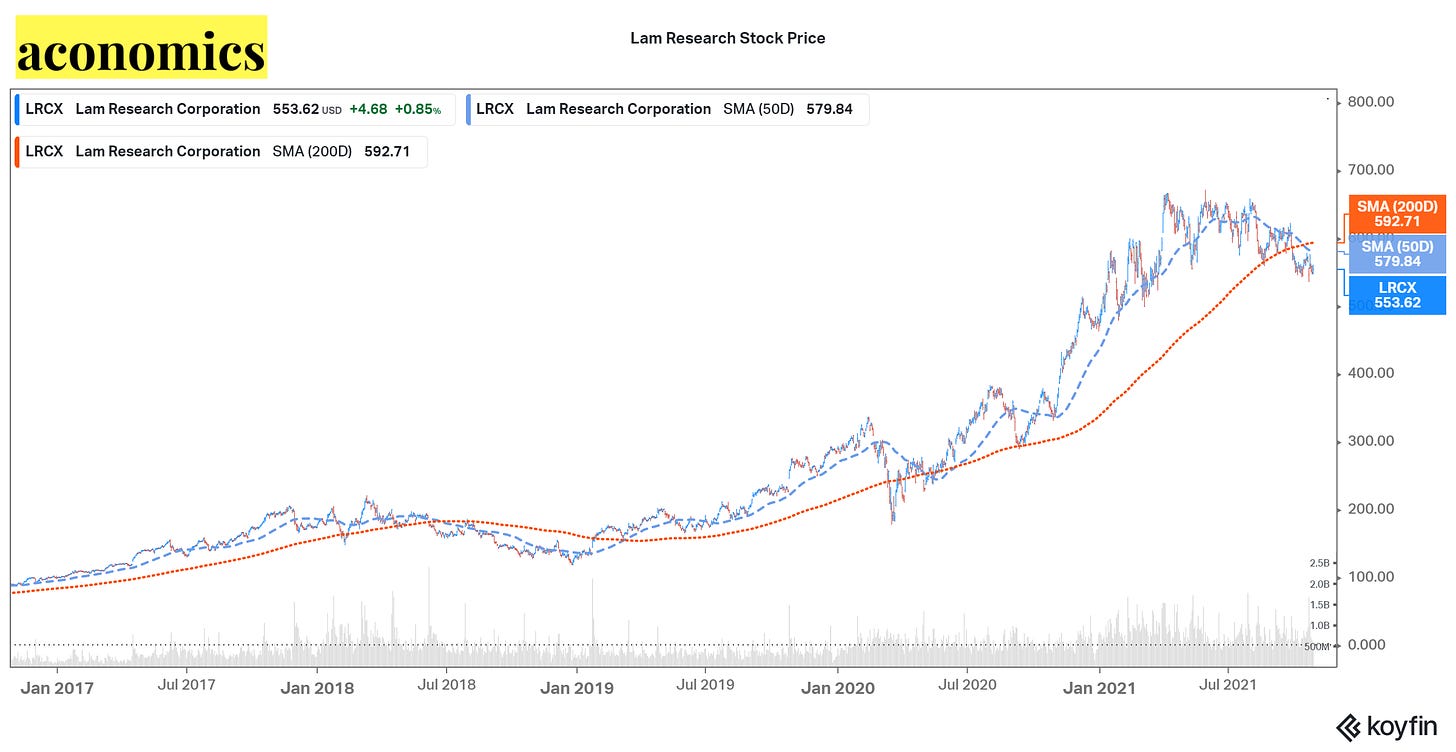

Stock & Price Target

With a Market Cap of 77.72B, an Enterprise Value of 78.11B, a PE ratio of 18.7, a dividend (recently raised) of $1,50/Q and an approved and active $5B share repurchase program the stock price isn’t really reflecting the potential of this company.

If we look at other players in the space like $AMAT, $KLAC, $ASML and $VECO, their Price/Earning ratio are much higher, they go from 23 to 130.

For all this reasons, from 26 analyst (10 Hold, 11 Buy and 5 Strong Buy) and their price targets, we get:

Low Price Target: 575$

Average Price Target: 691$

High Price Target: 800$

More semiconductor stocks that I like

Saying semiconductor stocks is an oversimplification because the industry is so large, so diversified and it touches so many industries.

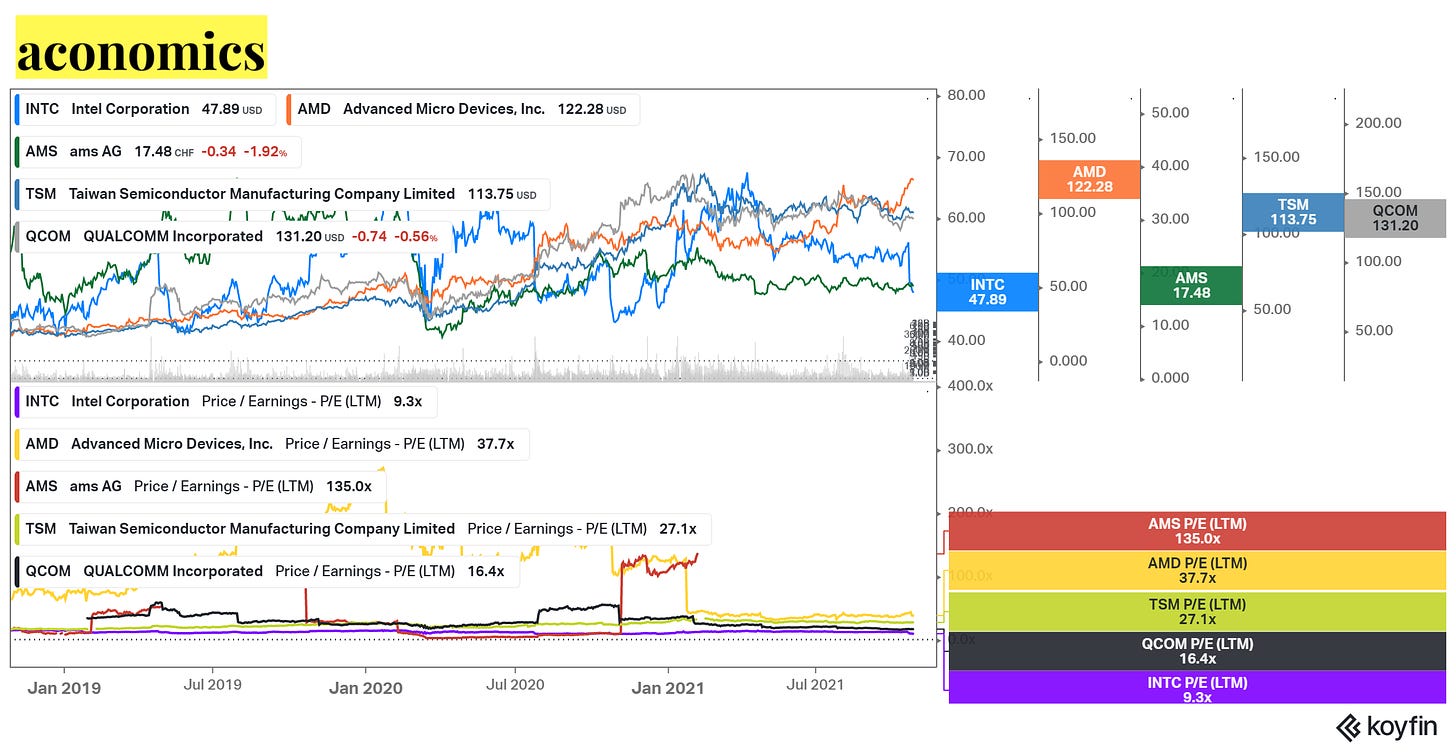

The assets that I own besides Lam Research are: AMD, AMS AG, TSM, QCOM and INTC:

And that’s it for this edition of Aconomics!

Until next time!

If you like my content, I would highly appreciate you sharing it and letting me know! And if you see a typo, an error or have anything else to point out, please do so in the comments or directly on twitter @aconomicscom

Disclaimer: I use and love Etoro and I’ve signed up to the affiliate program, some of their links are affiliate links. Also, all material presented in this newsletter are not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. In any case, transparency is paramount so my portfolio can be viewed here.