NIO Stock Analysis

Electric Vehicles are conquering the world and NIO is positioning itself to be a big player in China and the world. Still in its infancy, the market is valuing it above old timers like BMW.

Hi Everyone 👋

Welcome to the new subscribers who joined this week! If you’re reading this but haven’t subscribed, join our community, it's focused on economics, finance, stock market and crypto 👇

NIO is a Chinese premium electric vehicle manufacturer, competing on next generation technologies like autonomous driving and AI. Founded back in November 2014 by William Li and before we go deeper into the company and its numbers, lets just go over his life for a minute. I know it's not common for a stock analysis newsletter but trust me, it's worth it.

William Li - Not your typical founder

Born in 1974 in a small and poor village of the province of Anhui, China. His father worked in a coalmine and his mother in a garment factory that was 300km away from home. Mainly raised by his uncle and grandparents in this poor village that got electricity and roads when he was 10 years old.

Working at his grandfather "convenience store" early on he apparently showed good business sense but his parents had a more pragmatic plan for him and wanted to send him to technical school instead of university. Li thought otherwise, and at the age of 17, he took the national entrance examination for university and got the highest mark in his province which let him getting accepted at the top-ranked Peking University for his undergraduate studies where he pursued not 1 but 3 degrees, Sociology, Computer Science and Law (He recalls having at one point, up to 17 exams in one week) while working part time jobs, obviously.

After University, right before the dotcom boom, he started 2 companies, the first one didn't go far but the second one, started in the year 2000 was called Bitauto that offered content and marketing services for the auto industry, took it public in the NYSE (now delisted) in 2010 and left the company in 2013. After that, Li started Yixin, an automobile financing platform that he took public in the HKEX (Hong Kong Stock Exchange) in 2017.

Now that we all feel like losers, lets move on to NIO.

NIO Inc

NIO was created as a luxury electric car manufacturer startup. To start the company, even though he was already a billionaire (according to Forbes), making cars is crazy expensive so Li persuaded the "Crème de la crème" of Chinese entrepreneurs. Starting with some of Xiaomis founders and since then, more entrepreneurs and companies have invested, including Tencent, Baidu, Sequoia, Lenovo, and TPG.

NIO’s Chinese name, Weilai, which means Blue Sky Coming, that as they say, reflects the vision and commitment to a more environmentally friendly future. They have created a global company with:

Headquarters in Shanghai, China

Design team in Munich, Germany.

Software development in San Jose, California

Vehicle performance team in London, UK

Industry Analysis

The Electric Vehicle (EV) sector is exploding in popularity but the leading companies are still shipping less than 2 million cars a year. According to the analysis made by Ark invest, "If traditional automakers overcome obstacles, global EV Sales could scale 20-Fold from ~2.2 Million in 2020 to 40 Million by 2025." and that would by an 82% CAGR (Compound annual growth rate). Sales in 2019 grew by 19% YoY, and in 2020 it was 33% YoY, the trend is clear here.

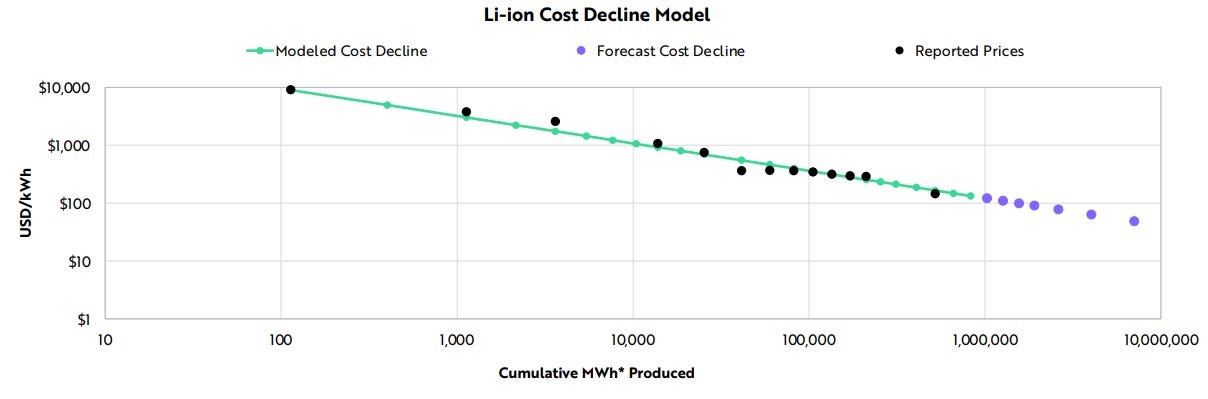

Battery cost has been one of the most talked about bottle necks in the electronic vehicles sector but so far, every time the production doubles, battery cell costs decrease 28%. Following Wrights Law, we’ll probably see price parity between electric and gas in the next couple of years.

Wright's Law or “The Learning Curve” A framework that helps express the relationship between experience producing a good and the efficiency of that production. Specifically, efficiency gains that follow investment in the effort. - Pioneered by Theodore Wright in 1936. Ark is big fan, read more here

Business Model

NIO generates revenue from vehicle sales (93%) and embedded products and services (7%). Gross profit for each category are not disclosed separately but in any case, net profits do not yet exist.

It produces 4 models: ES8, ES6, EC6 and the latest ET7. Actually they produced a fifth called EP9, only six units were made of this sportscar that went for 2.5 million pounds each.

Vehicle sales

In Q4 2020 was a big jump for NIO, delivering 4,873 ES8 models, 7,574 ES6 models, and 4,906 EC6 models.

Vehicles sales rose 130.0% to $946.2 million. Profit on vehicles sales was $163.2 million, a significant improvement from the gross loss of $24.7 million in the same three-month period in 2019.

In Q1 2021 NIO delivered 20,060 vehicles in the first quarter of 2021, a new quarterly record representing an increase of 423% YoY.

Other sales

NIO has a few other sources of revenue related to servicing the cars and providing a whole environment to its owners including charging stations, battery swapping stations, delivery charging, maintenance, software updates and club houses that include library, bar, showroom.

The BaaS program they launch, allows the buyers to save money when buying the car and they get free fast battery swapping for 150 USD a month.

In Q4 2020 this sales went up 184.1% to $71.6 million.

Competition

The EV sector is getting heated by the day, with old school companies making fast changes, as of 2021, the differentiating factor is technology and image. Tesla is now the biggest car manufacturer by market capitalization, small companies like NIO are worth more than BMW and BYD is huge and has the king of value investing (Warren Buffett) as its shareholder (8.2% of the company).

XPeng, Li Auto, BYD among other are at the cusp of conquering the biggest market for EVs, China. And if we know anything, we know that the Chinese government is going to promote Chinese companies above foreign ones.

Stock history, volatility and target price

First let see the linear price chart sense it went public in September 2018:

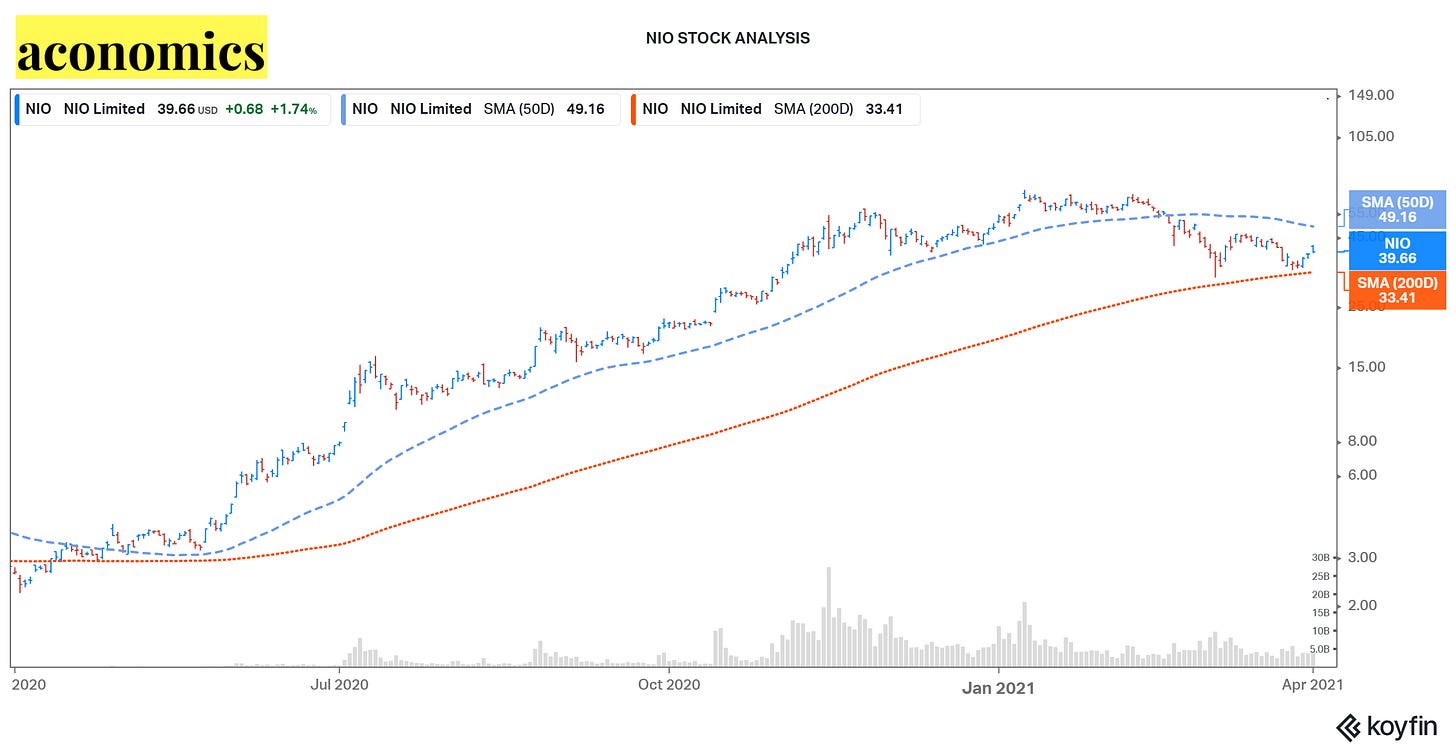

SMA (50D) and SMA (200D) is the Simple Moving Average for the stock in the last 50 or 200 days. Every day it sums the last 50 or 200 closing prices and divides it by 50 or 200. The aim of all moving averages is to establish the direction in which the price of a security is moving based on previous prices.

And here is the logarithmic chart that better shows the orders of magnitude of the changes in the last month:

At a 62.38 Billion dollar valuation, with a stock price of 39.66 USD today. It’s crazy to think that a start-up is worth more than BMW that has a worldwide presence and sold over 2.3 million cars in 2020.

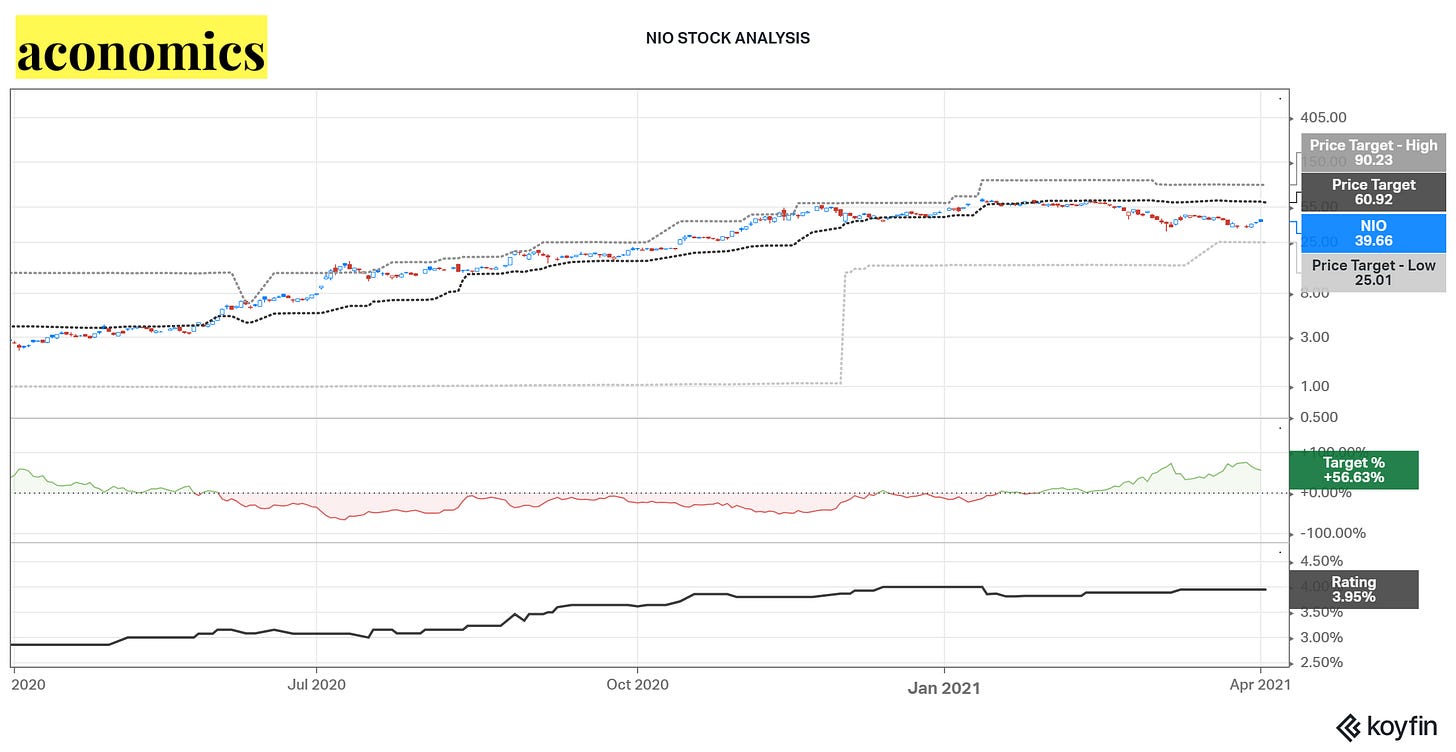

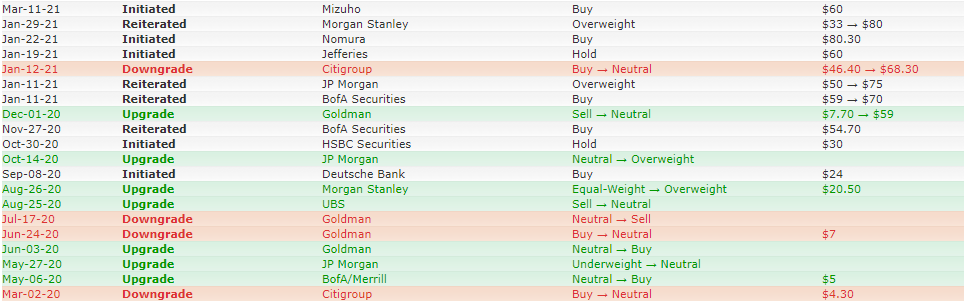

That being said, lets take a look at what the financials institutions expect as of today:

A few other price targets retrieved from finviz. This chart doesn’t say much more but I think its hilarious that Nomura values this Chinese stock above anybody else, I wonder if they kept the target price after last week clusterfuck.

If you don’t know why its funny, don’t worry, go google Nomura Archegos or wait until my next newsletter where I’ll go over it and explain Total Return Swap.

The Bottom Line

I like NIO, I like the founder and the products. I believe that they will become a big player in chinas EV market and if they manage to build a brand in the EU and USA, even better.

There is only two things I don’t kill for, the current valuation and I’m not a big fan of this holistic approach of creating libraries for the few hundred that have a NIO car but I’m still super bullish in the long term 3-5 years.

I don’t pay attention to the Tesla vs. NIO discussions, the market is big and there is a lot of room to grow for the foreseeable future.

Again, thank you for subscribing! If you like my content, I would highly appreciate you sharing it. And if you see a typo, an error or have anything else to point out, I don’t care! Just kidding, please let me know in the comments or connect on twitter @aconomicscom :)

And BTW, Now Aconomics has a YouTube channel. If you like the content, please consider liking and subscribing, it helps a lot :)

The video version of this post:

Like always, thank you. Remember to hedge your bets, ponder claims and think long term 👍

Disclaimer: I’m an investor in companies mentioned in this article like NIO and BMW. All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions.