The Disney Kingdom: Stock Analysis

The company that might just be getting started. From Parks and Resorts to Sports and Streaming, Disney is a shark with a very friendly face.

Hi Everyone 👋

Welcome to the new subscribers who have joined aconomics. If you’re reading this but haven’t subscribed, join our community! 👇

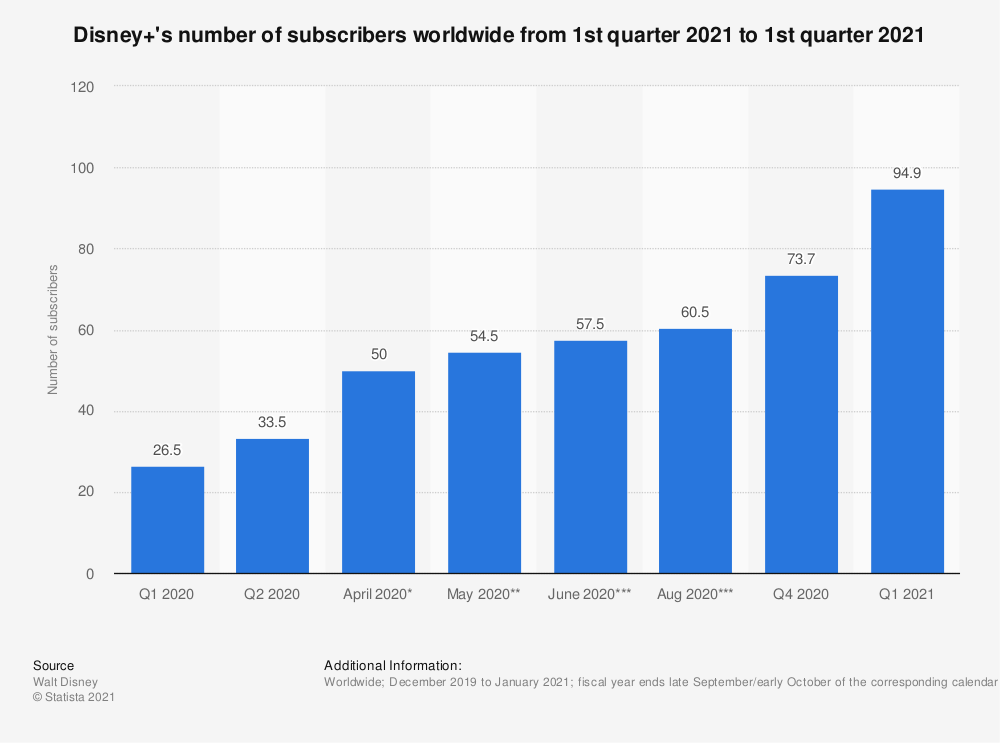

Disney was founded in 1923, by brothers Walt and Roy O. Disney as a Cartoon Studio. The company established itself as a leader in the American animation industry before diversifying into action film production, television, and theme parks. Since the 1980s, Disney has been expanding its services by creating or acquiring entities. The last of which was Disney+ that launched at the end of 2019 and grew to 100 million subscribers in just over a year.

The Walt Disney Company (DIS)

Its hard to get our heads around how BIG this company is, even though it had a horrible 2020 with a loss of 2.86B U.S. dollars, in 2019 it had one of its best years reporting a net income of 11.05B dollars and that was before they launched Disney+ (Nov. 2019).

What’s in the box?

At first I was going to include a list of all the businesses that The Walt Disney Company has a stake on but it was so long that I’m going to do what they themselves do and group them to make it shorter.

So when you see “Walt Disney World Resort in Florida” bear in mind that that includes theme parks (consisting of Magic Kingdom, Epcot, Disney's Hollywood Studios, and Disney's Animal Kingdom), two water parks, 27 themed resort hotels, nine non-Disney hotels, several golf courses, a camping resort, and other entertainment venues, including the outdoor shopping center Disney Springs.

I know, its f***ing crazy. Lets do this:

Cable Channels: ESPN (5 channels), Disney (3 channels), ABC, Freeform, National Geographic (2 channels), FOX, FX (3 channels), Star, Endemol & 20th century.

8 US Television Stations: WABC (New York, NY), KABC (Los Angeles, CA), WLS (Chicago, IL), WPVI (Philadelphia, PA), KGO (San Francisco, CA), KTRK (Houston, TX), WTVD (Raleigh-Durham, NC), KFSN (Fresno, CA)

Equity Investments:

50% of A&E Networks: A&E, HISTORY, Lifetime, LMN, FYI, Viceland.

30 % of CTV: Basically the ESPN of Canada plus the Discovery and animal planet.

Parks & experiences:

Theme parks and resorts: Walt Disney World Resort in Florida; Disneyland Resort in California; Disneyland Paris; Hong Kong Disneyland Resort (48% ownership interest); Shanghai Disney Resort (43% ownership interest); and Tokyo Disney Resort (IP licensing).

Disney Cruise Line, Disney Vacation Club, National Geographic Expeditions (73% ownership interest), Adventures by Disney and Aulani, a Disney Resort & Spa in Hawaii.

Consumer Products:

Licensing of trade names, characters, visuals, literary and other intellectual properties to various manufacturers, game developers, publishers and retailers throughout the world, for use on merchandise, published materials and games.

Sale of branded merchandise through retail, online and wholesale businesses, and development and publishing of books, comic books and magazines.

Studio entertainment: Walt Disney Pictures, Twentieth Century Studios, Marvel, Lucasfilm, Pixar, Searchlight Pictures, Blue Sky Studios banners and live entertainment events on Broadway and around the world, music production and distribution, etc.

Direct to consumer (DOC) & International:

Streaming services: Disney + / Disney+Hotstar, ESPN+ and Hulu.

Networks and channels: Disney, ESPN, Fox, National Geographic and Star.

Technology: BAMTech, a streaming technology pioneer, is owned 75% by the Company, 15% by MLB and 10% by the National Hockey League (NHL).

And that’s about it. The result of a profitable company that hasn’t stop investing in decades but until now, it couldn’t be consider a tech company. This could change.

Industry Analysis

Obviously, we cant analyze every industry Disney touches but we can focus on the one that’s going to bring a huge block of recurring revenue and catalogue Disney as a technology company.

Streaming Services AKA SVoD (subscription video on demand) has been growing fast in the last 5 years and there is no signs of it stopping any time soon. With a projected combined revenue of +70 Billion dollars in 2021 and the expected growth, by 2025, the revenue will be +108 Billions Worldwide.

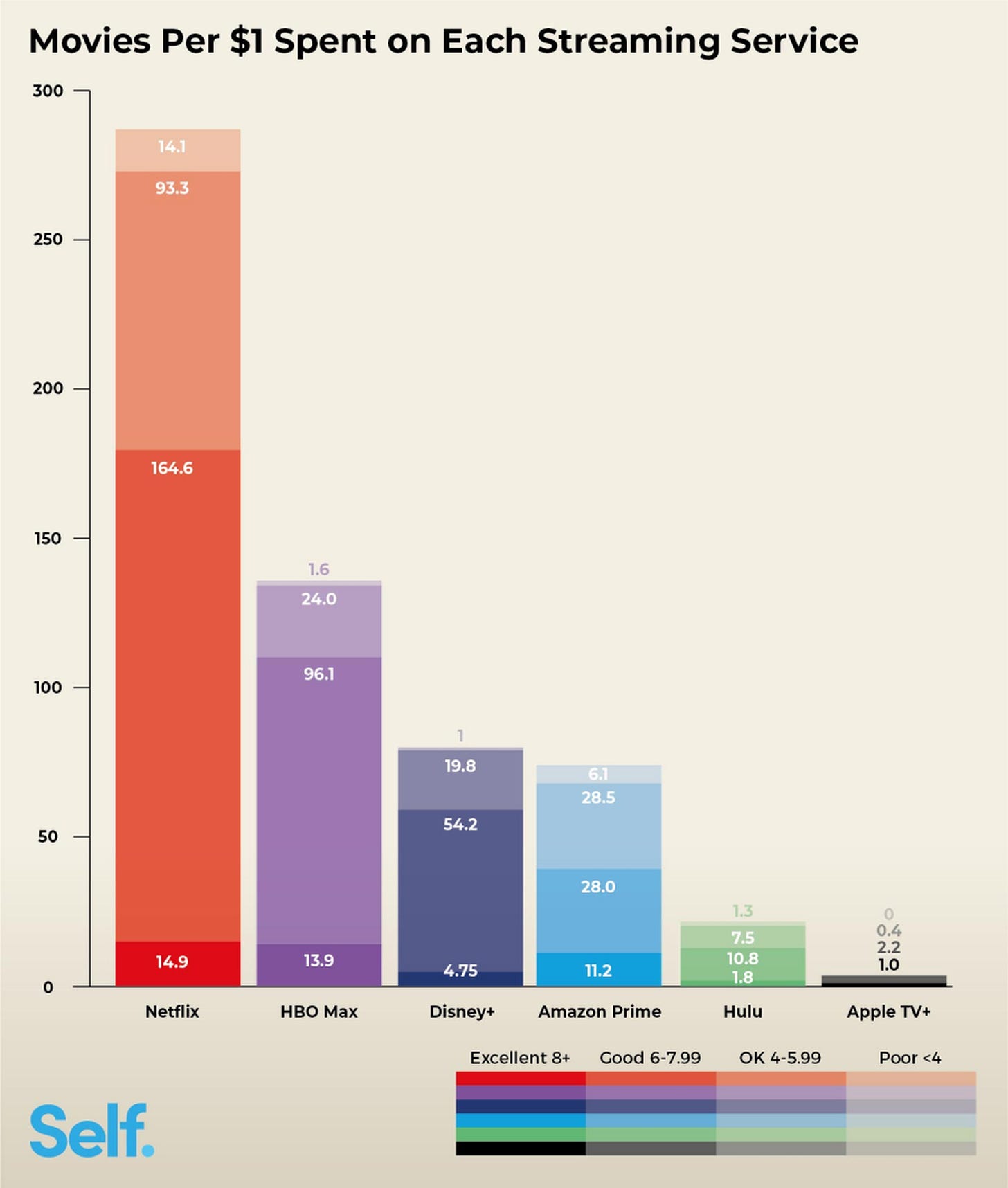

Even though Netflix, Amazon Prime, HBO and Disney+ are on an international competition. Netflix is still the top player and its all about content:

Disney+ has existed for 18 months and has an allocation of 14 to 16 Billion dollars for streaming content a year until 2025, to hopefully bridge the gap in volume of users. Netflix is crossing the 200 million this quarter according to the estimates and Disney should count with 130+ Millions, without counting the 40+ of HULU and 10+ of ESPN.

Stock history and target price

First let see the linear price chart sense it went public in September 2018:

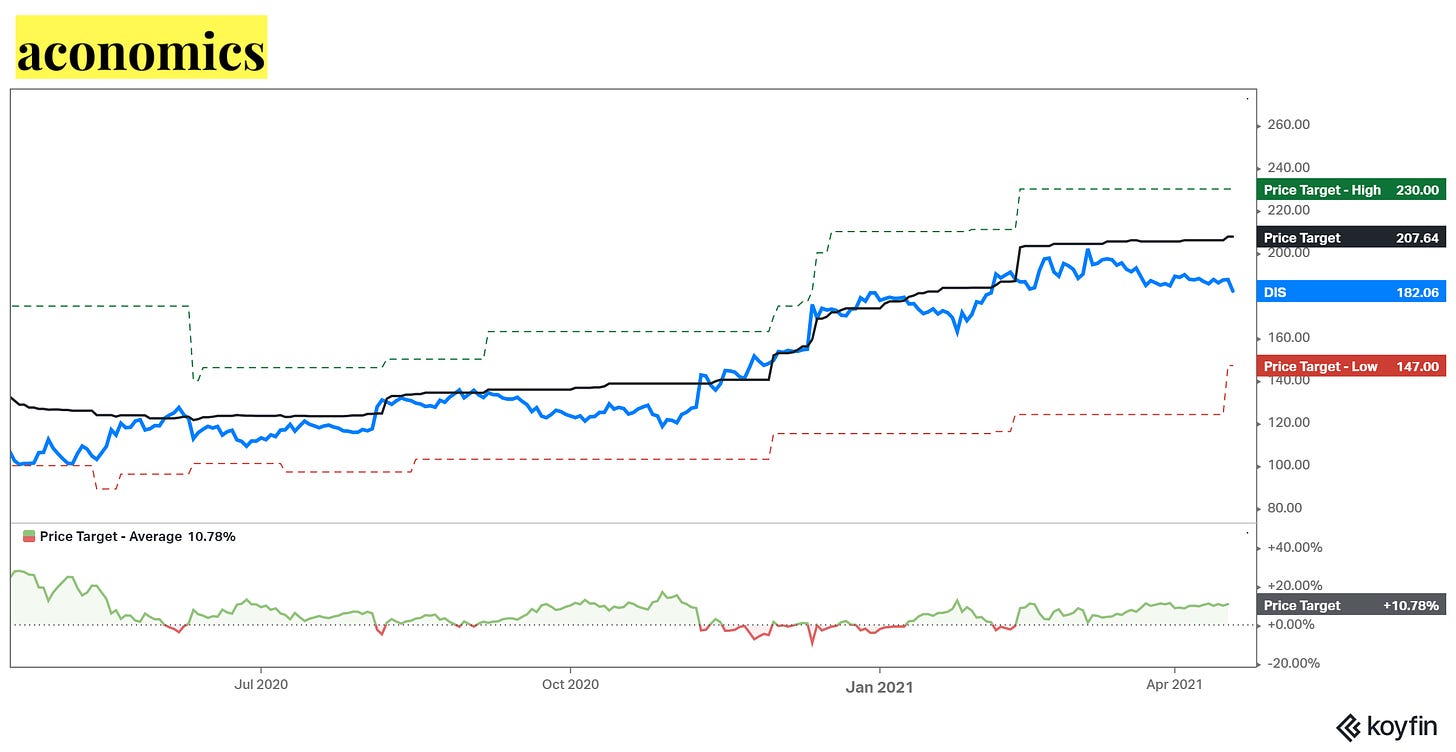

SMA (50D) and SMA (200D) is the Simple Moving Average for the stock in the last 50 or 200 days. Every day it sums the last 50 or 200 closing prices and divides it by 50 or 200. The aim of all moving averages is to establish the direction in which the price of a security is moving based on previous prices.

At a 330.75 Billion dollar valuation, with a stock price of 182.37 USD today, its fair to say that most analyst still value Disney as Parks and Resorts Business and not the Tech giant that its becoming into.

The high Price Target is 230:

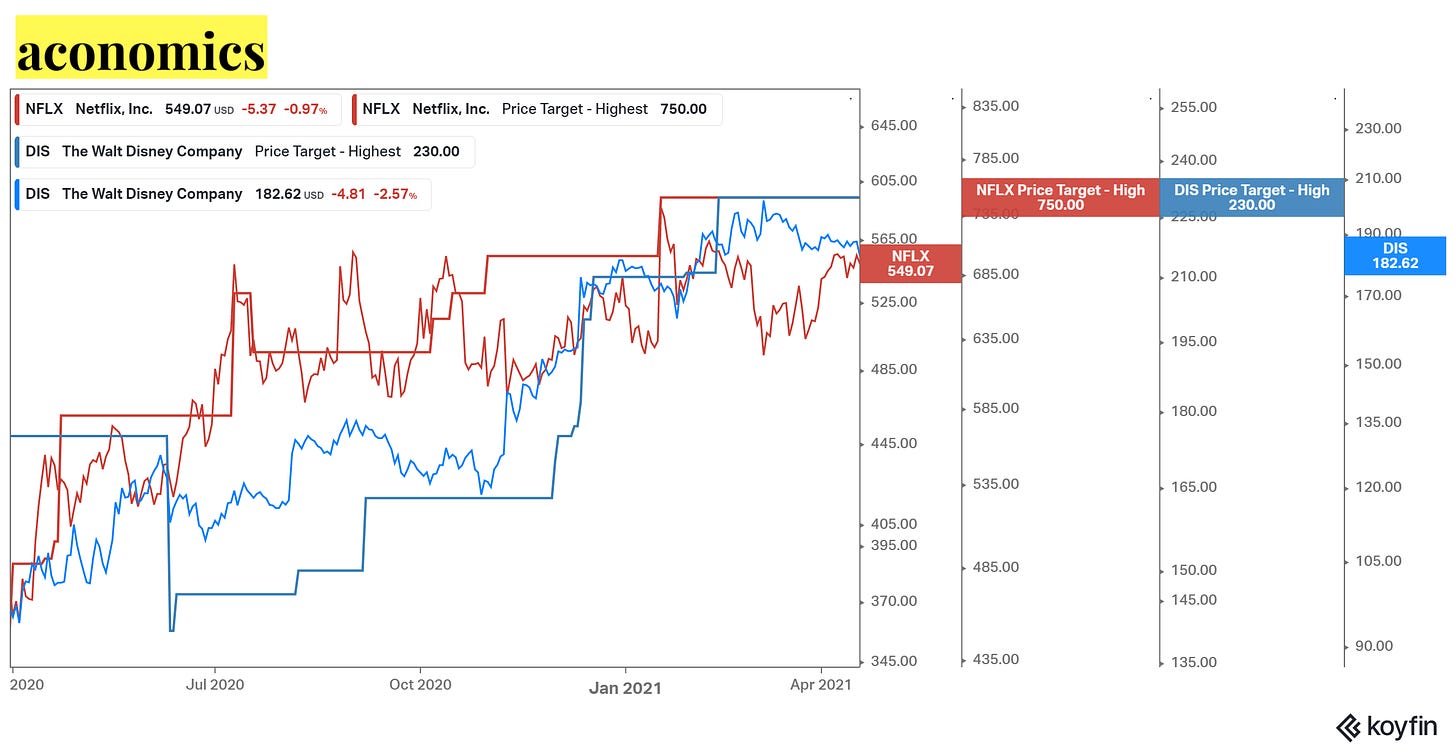

But what about its closest competitor just in the streaming service, a sweetheart of the technology stocks: Netflix

Netflix has a Market cap of 245 Billion Dollars and a P/E ratio of 93.

The Bottom Line

Since launching Disney +, Disney has added only 76 Billion to its Market Capitalization. I believe it should add another 200 Billion in the next 3 to 5 years.

Until next time!

Again, thank you for subscribing! If you like my content, I would highly appreciate you sharing it. And if you see a typo, an error or have anything else to point out, I don’t give a f! Just kidding, please let me know in the comments or connect with me on twitter @aconomicscom :)

Remember to hedge your bets, ponder claims and think long term 👍

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. In any case, transparency is paramount so my portfolio can be viewed here.