Before we begin, thank you for subscribing! If you like my content, I would highly appreciate you sharing it. And if you see a typo, an error or have anything else to point out, I don’t care! Just kidding, please let me know in the comments or email me directly :)

In this newsletter we’ll cover:

Brief history of Short selling.

What is Short selling (covered and naked).

Benefits of short selling and its downside.

Regulations (no naked and uptick rule)

What happened with GameStop (r/wallstreetbets and short squeeze).

Some short sellers and resources to follow.

Short selling - Going short - Shorting stocks - GameStop - AMC - Melvin Capital. How many times have we seen them on the news lately? Sadly, more than they should have and for the wrong reasons. It’s been a crazy year and I’ve never seen so much BS being published on social media about shorting, the stock market and investing in a long time!

I’ve heard that shorts are destroying the economy, they are greedy sons of bs, all bastards! Specially with the whole GameStop debacle and r/wallstreetbets. - Well, I'll just come out and say it, I like shorts. And NO, I don't short stocks, nor I recommend for retail investors to partake in any short either, but I'm very happy they exist, I follow many and I'll tell you why. But lets start from the beginning just because it’s interesting.

A tiny bit of history about Shorting Stocks

As far as we know, the first Short Seller in history was Isaac Le Maire, one of the largest Shareholder of the Dutch East India Company (VOC) back in 1609. When he, in an attempt to hurt the stock, founded a secret company and started trading VOC stock on loan. Hoping they would drop in value because of a big rumor of a French competitor coming up (which he had something to do with :/ ) but in the end, nothing happened, the French king was dead and plans where shelved.

For some reason, Mr. Le Maire hated the VOC and he tried using short selling as a revenge tool. But there is another side of the story, markets have become way more transparent and efficient. Kings are not involved with the stock market (the closest thing we have are hedge funds and Elon Musk) and after a few hundred years, we've learned a thing or two.

That’s it, no more history - I kept it short ;)

What exactly is Short Selling?

Maybe this should have been at the beginning of the article but I assumed everybody had an idea. In any case, here I'll explain what it is and how it works before we continue to short squeezes, SQQQ, benefits and pitfalls of short selling.

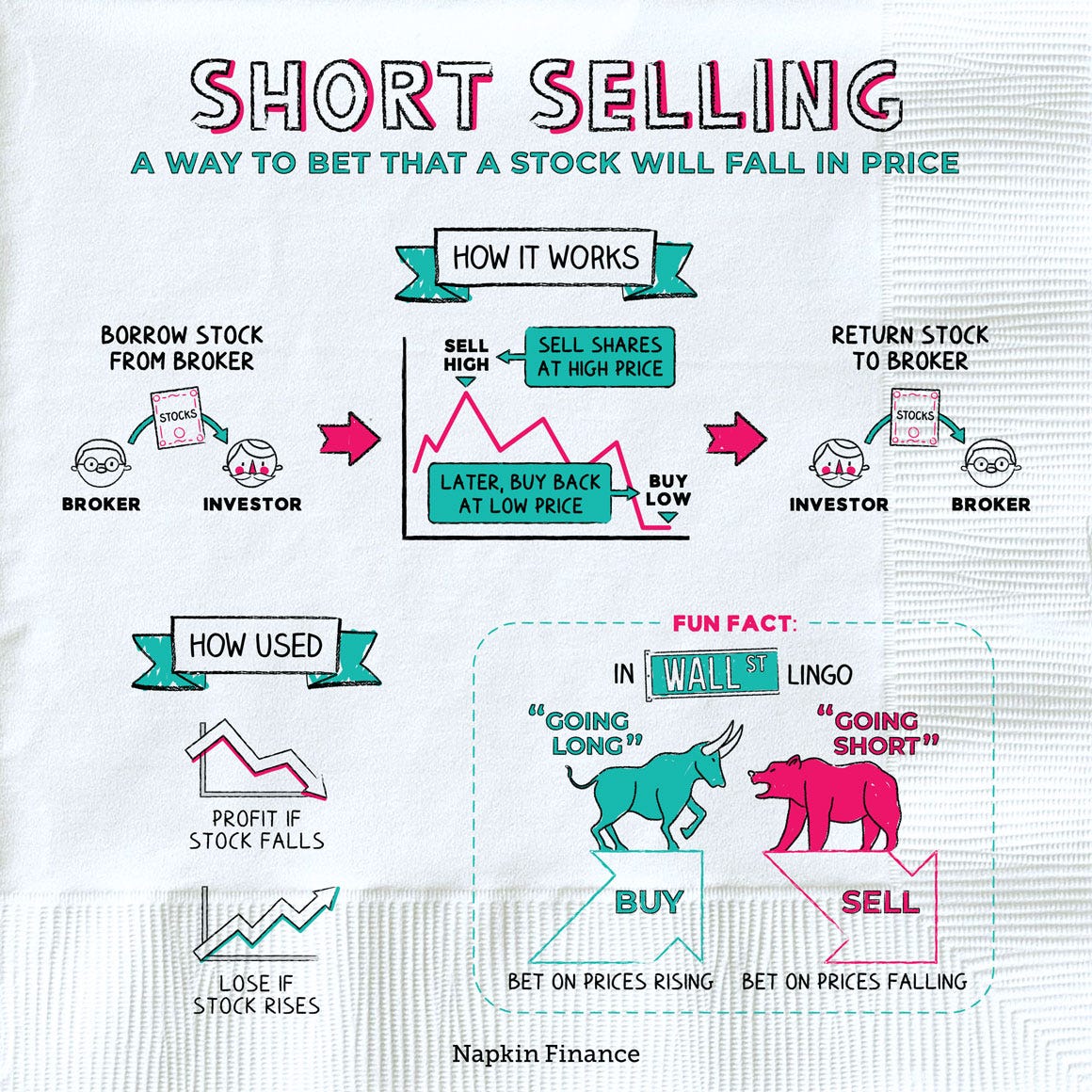

Short selling, a short or a short position, is created when a trader sells a security first with the intention of repurchasing it or covering it later at a lower price. Here is a graphic made by Napkin Finance explaining it.

Now, bear in mind that when creating a short position, one must understand that the trader has a finite potential to earn a profit (security going to zero) and infinite potential for losses (security going to the moon or a short-squeeze).

There are two types of short positions:

Covered: The trader has the stock he's selling.

Naked: The trader sells a security without having possession of it.

Naked Short selling has been banned (after the 2008 financial tumble) in the US and Europe because they increase the short pressure on a stock with non-existing shares but due to various loopholes in the rules, and discrepancies between paper and electronic trading systems, naked shorting continues to happen.

Benefits of Short Selling

If we think about how crazy it is to go short on a stock, it makes you wonder, why? why would somebody do it? I mean:

The profit is capped at the value of the stock but the losses have no limit.

You’ll never make friends because if you win, your celebrating when when portions of the economy suffer. As Charlie Munger answered when asked if he shorted stocks, “We don’t like trading agony for money”.

You’ll be blamed for accelerating and worsening sell-offs, such as those that led to the Great Depression and the more recent 2008 recession.

Human nature dictates that nobody like the ones that go against the pack.

The title of this section seems ironic, I know. But, now you understand my fascination with short sellers, they are contrarians.

So, why would somebody do it? Well, I can only assume that it has to be for at least one of the following reasons:

You’re sure that the company is overvalued. You studied the fundamentals, made your analysis and predictions to make the decision. Shorting professionals lead to better market research and help the market by adding selling pressure on over-valued companies

You suspect there is a something wrong, something fishy even when the whole world seem blindly in love with a company. Like what happened with Enron, Lehman brothers, Lucking Coffee, etc.

Is it always good for the market then?

Not at all! In some cases where there is malicious intent (like our friend Isaac Le Maire in 1609) or the market entered a crisis like in 2008, short selling just exacerbates the situation, shorting becomes a safe bet because the whole market is going down, ruining companies and vanishing wealth is just horrible when done in the name of greed and not in the best interest of the market. That’s why the SEC and the EU's securities markets regulator have been banning the what and when for short selling.

Regulations on Short selling

The US and EU have similar basic regulations regarding short selling. These are aiming, as we mentioned earlier, at allowing short selling when it helps the markets:

No Naked shorts allowed. Just like in the US, in the EU, ESMA’s SSR (short selling regulation) aims to increase the transparency of short positions held by investors in certain EU securities. Where all short sales of shares must be covered.

The Uptick Rule: this 1934 rule required that short sales could only be entered when a stock’s price increased relative to the previous price. This rule was repealed by the SEC in 2007, but a variant was enacted in 2010. The new one essentially states that the uptick rule comes into effect for any stock that has lost more than 10% of its value in a single day. — This rule prevents sellers from accelerating the downward momentum of a securities price already in sharp decline. By entering a short-sale order with a price above the current bid, a short seller ensures that an order is filled on an uptick.

It’s amazing the coincidence between the repeal of the uptick rule in 2007 and the 2008 financial crisis 🙄 but I’ll stop myself here, lets not go into a rabbit hole of what-might-have-been theories. BUT, if you are interested, here you can find a paper on it.

WTF happened with GME and r/wallstreetbets?

This topic has been widely covered so I’m going to spare you the minutia of reddit’s channel and community objectives.

Long story short, the investing community on the reddit channel wallstreetbets saw that one of their favorite companies, a staple in gaming for gen z and millennials was being shorted hard, very hard. Possibly because the entities like Melvin Capital did their research and got to the conclusion that the company was not going to survive the digital transformation.

The reddit community decided to pump the stock by buying, holding and buying more, not allowing the price to go down, instead, they made it go up, a lot! And when shorts had to close their positions, they had to return the borrowed stock by buying at a very high price, making companies like Melvin capital lose an staggering 53%.

That is all fine and dandy, for once there was a public battle between main street and wall street and the former won. That’s amazing! but nobody is talking about the business.

GME is being valued today at 200 USD/share, with a 14.07B Market Cap and has a -5.3% profit margin and a whooping 2B in long term debt. Not to mention that the price target given by every institutional investor is on average 15/share.

So, I’m all about the people having power to invest and limiting the amazing advantage that wallstreet has on us. But lets not make this look like a revolution, the financials of the company do not sustain the price and eventually reality will win and a lot of small investors are going to lose money, especially the ones that take investment advice from tiktok and decide to join the fake revolution against wall street.

And that is it, thank you for reading! Let me know in the comments if you agree, disagree, forgot something or want me to cover any specific subject. And please share if you like my content :)

Hedge your bets, ponder claims and think long term.

Resources and Short Sellers to follow

David Einhorn from Greenlight Capital, described as a "long-short value-oriented hedge fund". He wrote a fantastic book called: Fooling Some of the People All of the Time, A Long Short.

Jim Chanos, a famous investment manager that shorted Enron, Lucking Coffe and Wirecard AG. If you want to know more about Enron, I highly recommend this book: The Smartest Guys in the Room.

George Soros who shorted the British Pound in 1992 among other amazing things, he is persona non grata in more than one country, he’s famous for "breaking the Bank of England". He has many books, I just like this one: The Alchemy of Finance.

Hindenburg Research is an investment research firm with a focus on activist short-selling founded by Nathan Anderson. Amazing research on their website. Recently famous for exposing and shorting NKLA stock.

That’s it for now, see you soon.