Welcome 2022? Here we go!

Here we are! 2022 and about to hit our second year living with Corona and over 3 years of a crazy Bull Market. - Will it continue? Omicron and Inflation have the stage.

Bonjour! 👋👋 & Happy New Year!!!

First of all, welcome to the new subscribers who joined since last time!! I know I’ve been away for a while but I had to visit family, I had to, christmas :/ But I’m back now and on this week’s edition of Aconomics:

[1] Welcome 2022 - Here we go! Inflation & Omicron

[2] A Stock I’m flirting with.

[3] Funny meme or recommendation

If you’re reading this but haven’t subscribed, do it 👇 And If you like it and want to share it on social media, you have my blessing 😉

[1] Welcome 2022?

Here we are. 2022 and about to hit our second year living with Covid and over 3 years of a crazy Bull Market.

It sound weird no? 2 years of the worst pandemic ever but the bull market continued?

It’s like papa Powell and mama Lagarde have been protecting us from the harsh reality and we have gone nuts and way to confident! Free money is like oil, it helps the machine run smoothly and keeps it running, but too much can flood the engine.

A new kaka coin? millions! A new Ape png? Hey its an NFT so Millions! A company that makes awesome promises and uses words like Electric, DeFi or Crypto? Billions! What I’m saying is, I believe the band is getting tired and music is about to slow down a bit.

Now, that does not mean I think the S&P will have a bad year, not at all! But:

Price Earning ratios will contract to normal levels.

Bad earnings will be punished. Specially in pre-revenue companies.

Rate hikes by central banks will obviously reduce valuations for every analyst (That’s just the way Discounted Cash Flow models work) and that will translate into lower price projections.

A lot of chartists will finally realize that fundamental analysis is the way to go :)

Inflation & Corona

As investors, the battle for our attention this first half of 2022 is going to be between the Corona variant (Omicron might be the one) and the Consumer Price Index.

On one hand, we got Corona, if it was a person, it would be the bad influence, the epicurean if you will, the one that always convinces central banks and treasuries to spend more, print more, and don’t think about tomorrow.

On the other, Inflation. The strict one, the one that wants you to understand the value of the dollar, the stoic if you will. The one that makes the FED behave responsibly and forces it to be the bad-cop, to make everybody behave and clear the party up.

Both will play an important role in:

The speed of tapering.

The number of rate hikes and their value - Goldman Sachs is predicting 4!

The S&P500 is already 2% down 10 days into the year.

My prediction

I’m an optimist by nature. I believe Inflation and Corona will not be an issue by the third quarter of 2022. But obviously, this prediction comes with a BIG IF and a lot of praying.

If the current studies are correct, the Omicron variant will be the predominant one and even though it spreads like wild fire, the vaccines are effective and the mortality rate is low and manageable. So I hope, this continues to be the case.

Inflation. High inflation is not good, we understand this BUT a silver lining of all this money printing is that it speeds up the rate of innovation. Just look at the rate of innovation with the mRNA vaccines! - I believe, the inflation drama will last 2 quarters. That the supply chain bottle necks will fade and energy prices will stabilize again (Given that the situation in Kazakhstan is resolved and neither China or Russia invades any territory) :)

So brace yourselves for a tumultuous year and if you are thinking of rebalancing your portfolio, you might want to:

Stay away from assets that are not generating cash.

Stay away from companies without price elasticity.

Look for value and low PE, low PEG and if its possible, an EV/EBITDA below 14 ( The S&P historical max).

What asset are you bullish on in 2022??

[2] A Stock I’m flirting with.

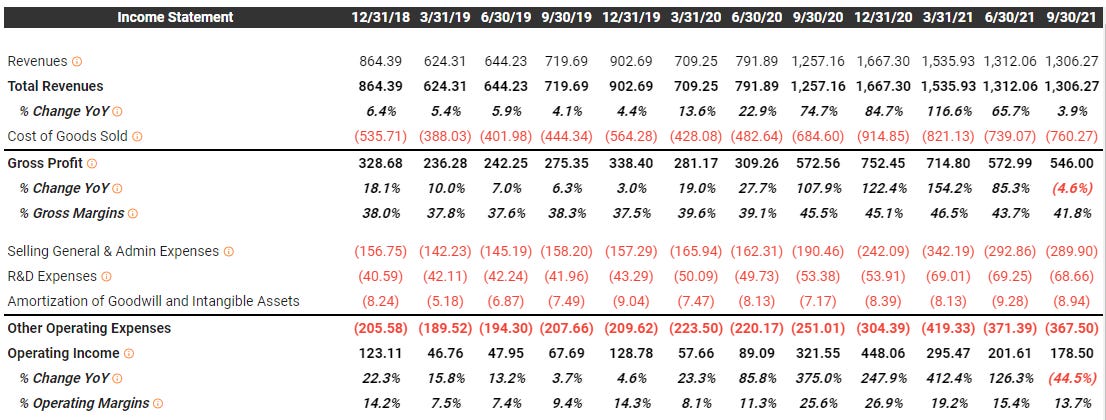

As always, here I talk about a company that intrigues me and I’m researching. In past editions I’ve mentioned companies that are very futuristic and that are most likely going to have a bad 2022 (pre-revenue, high valuation, etc.) so today I bring you one that might sound too old-school but the fundamentals scream VALUE!

Logitech

Logitech designs and creates products for computing, gaming, video, streaming and creating, and music. Brands of Logitech include Logitech, Logitech G, ASTRO Gaming, Streamlabs, Blue Microphones, Ultimate Ears and Jaybird. Founded in 1981, and headquartered in Lausanne, Switzerland, Logitech International is a Swiss public company listed on the SIX Swiss Exchange (LOGN) and on the Nasdaq (LOGI).

I’m making a video on Logitech today so head over to https://www.youtube.com/aconomics

My last one was on Duolingo:

[3] Funny meme or recommendation

By now, we all now that Nancy Pelosi has left all other investor in the dust, her skills for stock picking are unparalleled! This made me laugh.

And that’s it!

If you like the content, I would highly appreciate you sharing it and letting me know! And if you see a typo, an error or have anything else to point out, please do so in the comments or directly on twitter @aconomicscom - Thank you!

Until next time!

Disclaimer: I use and love Etoro and I’ve signed up to the affiliate program, some of their links are affiliate links. Also, all material presented in this newsletter are not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. In any case, transparency is paramount so my portfolio can be viewed here.